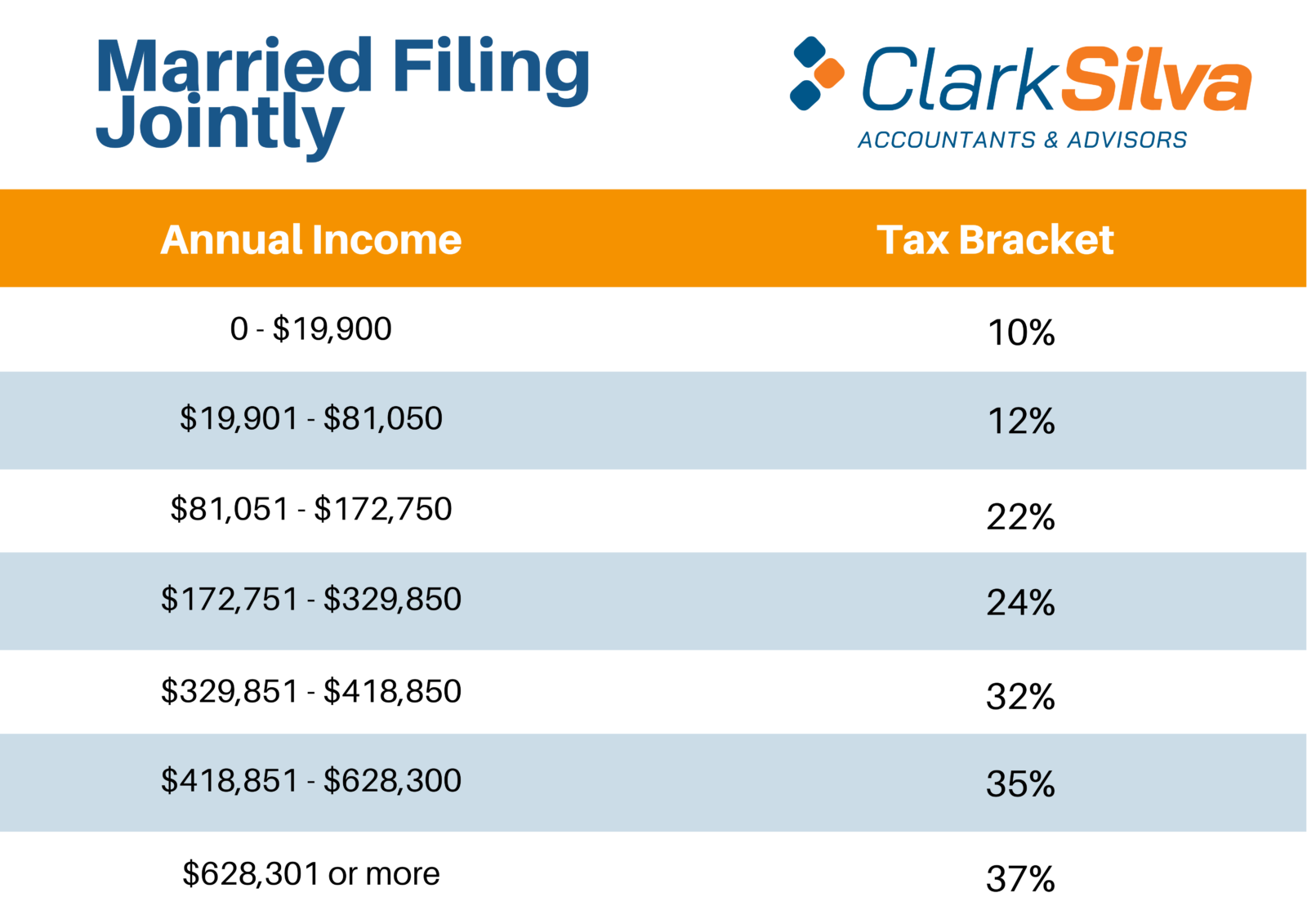

Capital Gains Tax 2025 Married Filing Jointly Uk. The niit tax rate is. How you report and pay your capital gains tax depends whether you sold:

Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates and allowances. — capital assets like stocks, shares and land and property can be transferred between spouses without triggering a capital gains tax liability.

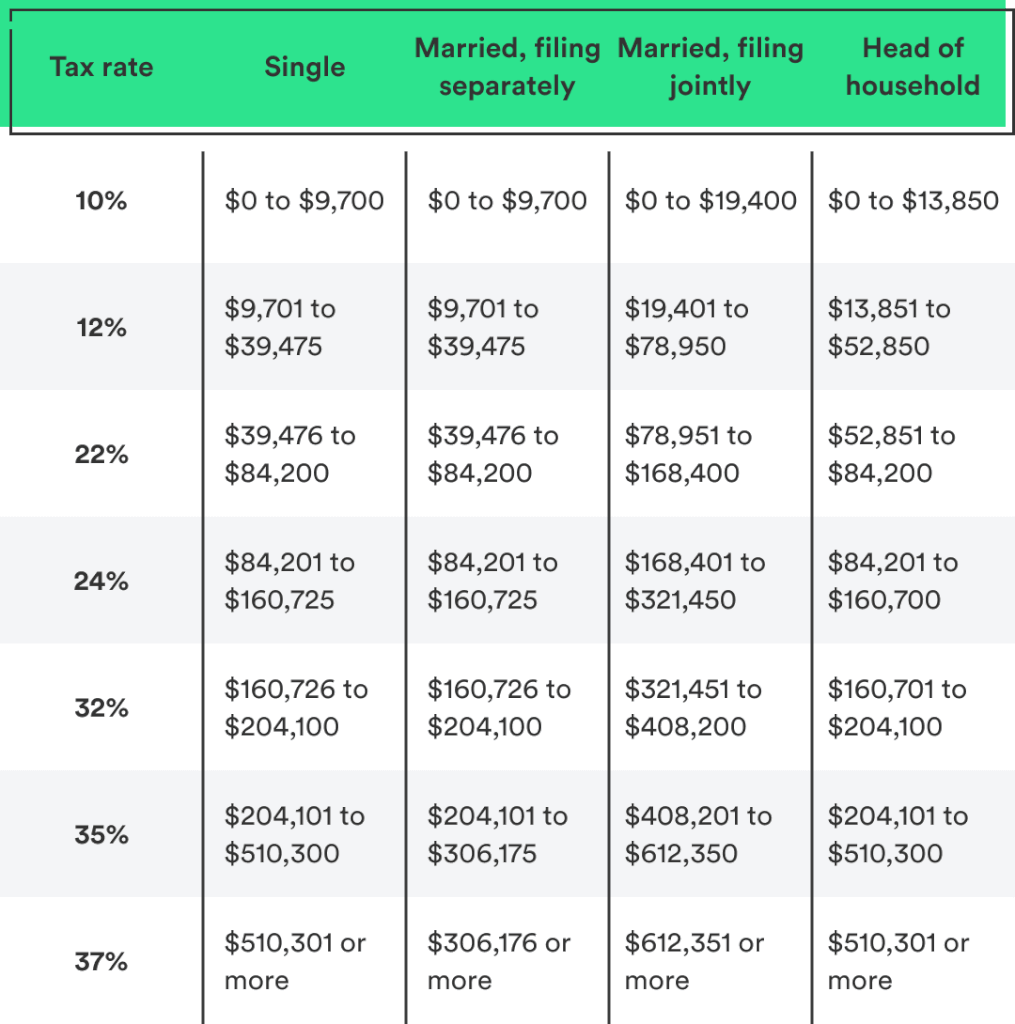

Tax Brackets 2025 Married Filing Jointly Cordi Paulita, Because the combined amount of £29,600 is less than.

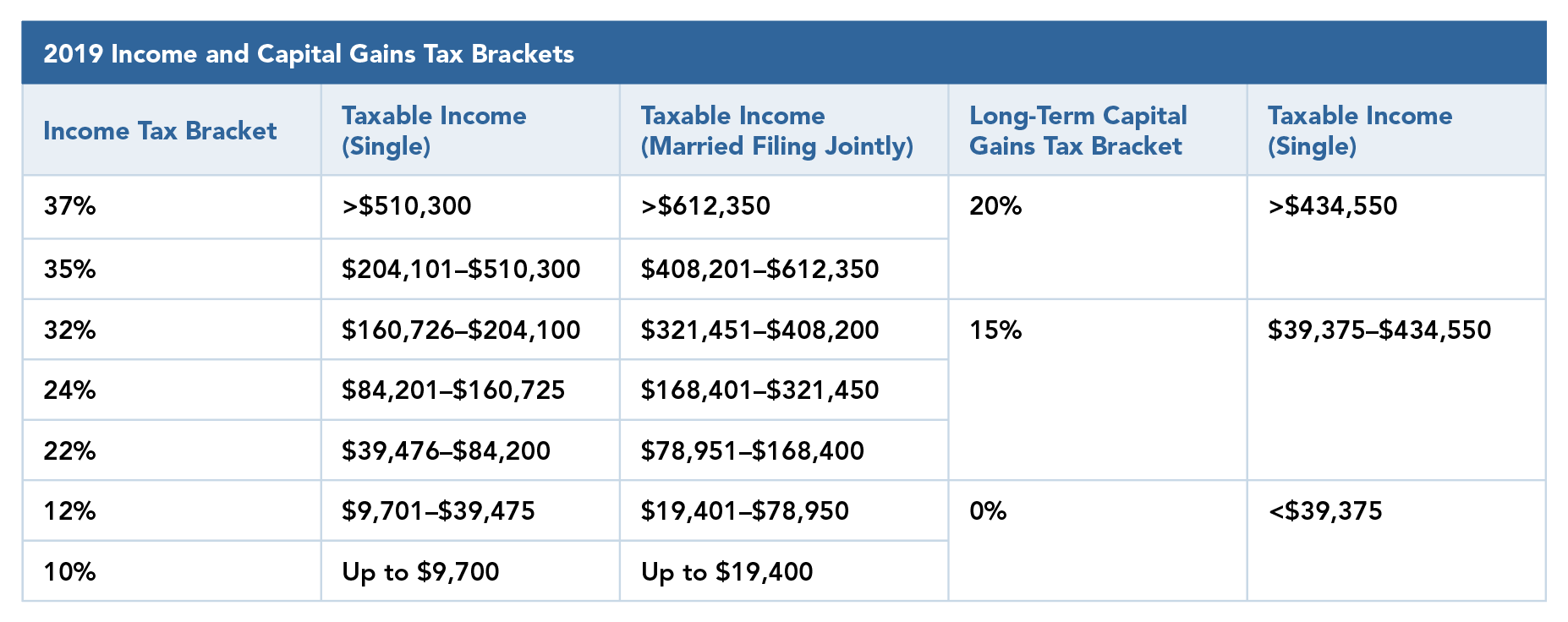

Married Filing Jointly Capital Gains Tax Brackets 2025 Megen Sidoney, Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates and allowances.

Capital Gains Tax Rate 2025 Elane Harriet, How you report and pay your capital gains tax depends whether you sold:

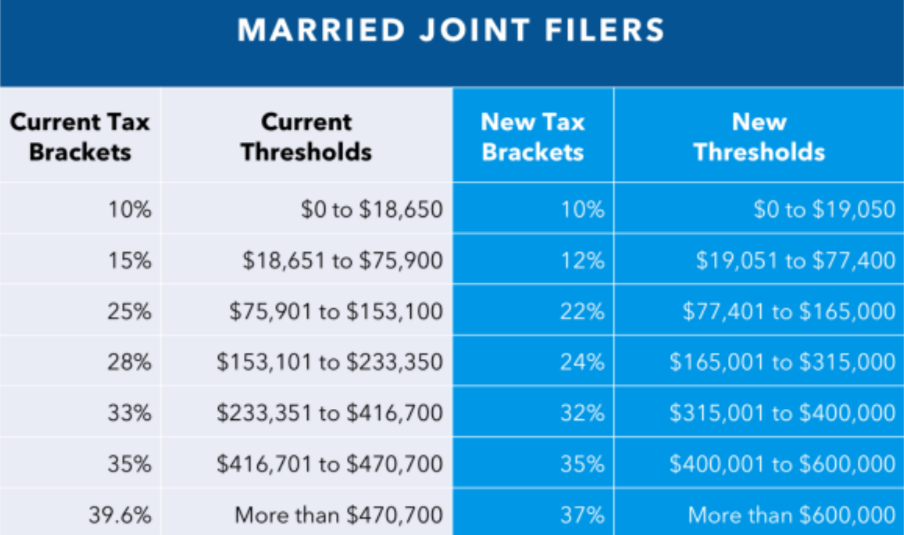

2025 Tax Rates Married Filing Jointly Cammi Corinna, How you report and pay your capital gains tax depends whether you sold:

Capital Gains Tax 2025 Married Filing Jointly Ricky Madelon, — good eveningmy mother owns a rental property (mortgage free) and is thinking of transferring (as a gift) 5% to myself.

2025 Tax Brackets Married Filing Jointly Uk Hilde Charlotte, The rate of cgt that you pay each year depends on the type of asset you’ve sold and.

2025 Tax Tables Married Filing Jointly Glenn Kalinda, For the 2025 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Tax Brackets 2025 For Married Filing Jointly Mag Imojean, A residential property in the uk on or after 6 april 2025.

Capital Gains Tax 2025 Married Filing Jointly Jojo Roslyn, You need to pay capital gains tax when you sell an asset if your total taxable gains are above your annual capital gains tax allowance.